Welcome to Your Financial Management Solution

This guide will help you navigate through all the features of our application. Click on any section to learn more about how to use that feature.

Transaction Management

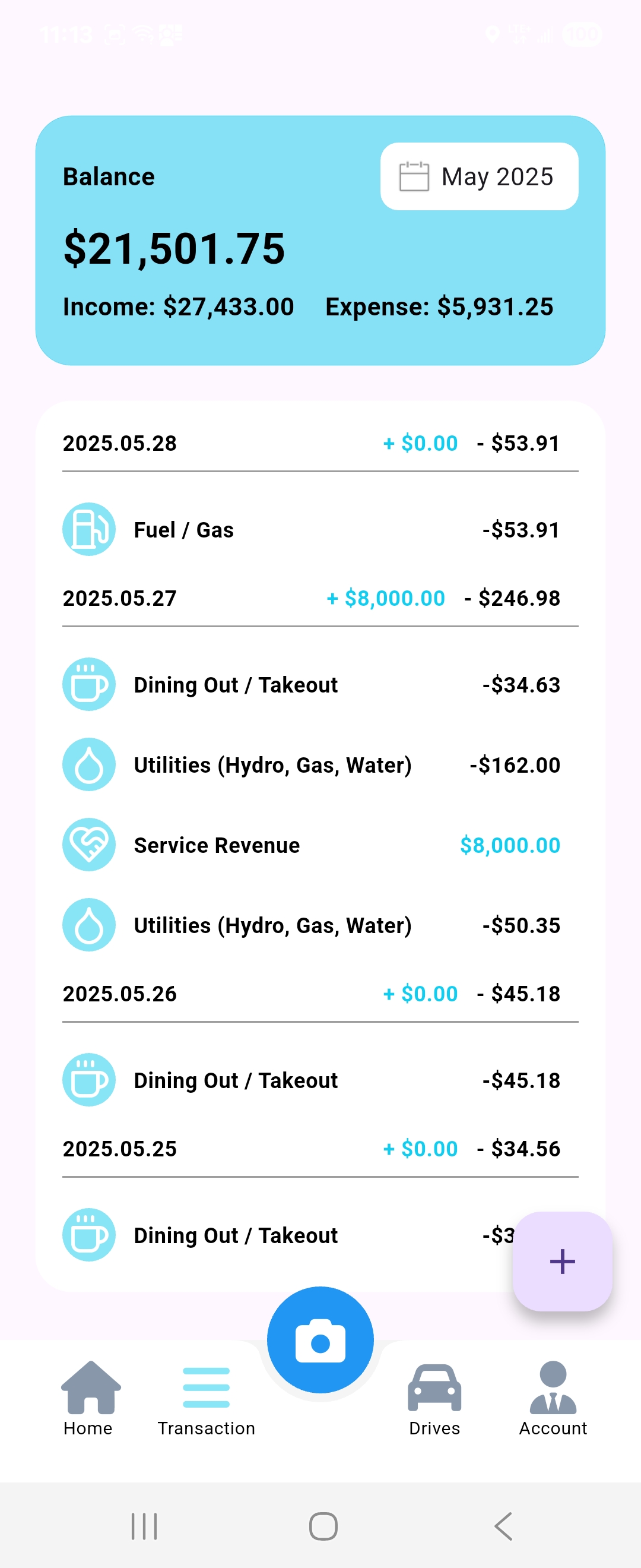

View Your Transactions

From the Dashboard, access the Transaction List to see all your recorded financial activities in one place.

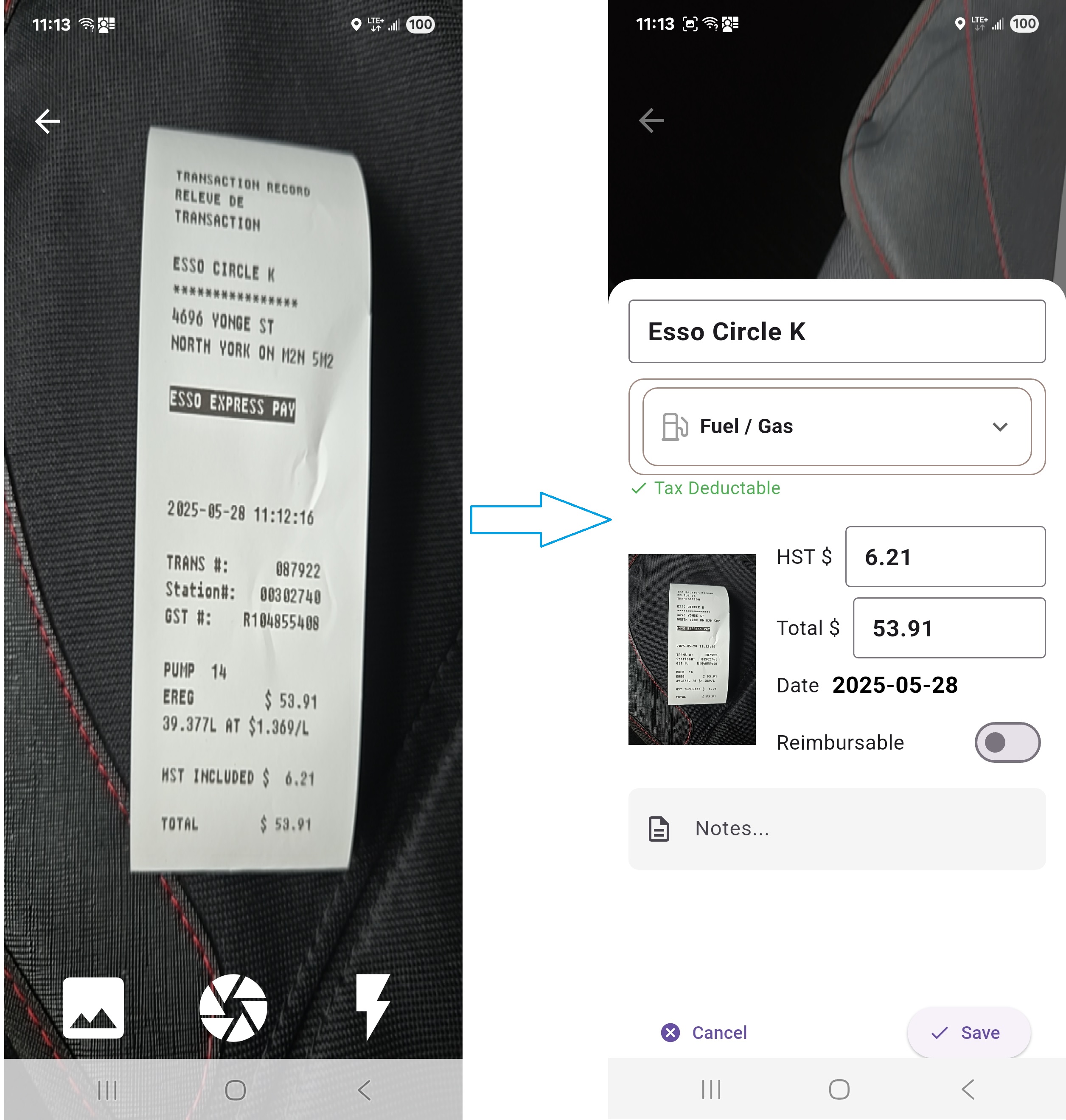

Add a New Transaction

You can log each income or expense via the Finance Tracker on the web or through the mobile app.

- Web: Upload a receipt, and the system will automatically extract the amount using AI.

- Mobile App: Snap a photo of the receipt for AI to detect amount and category.

Receipts are saved securely online — no need to keep paper copies!

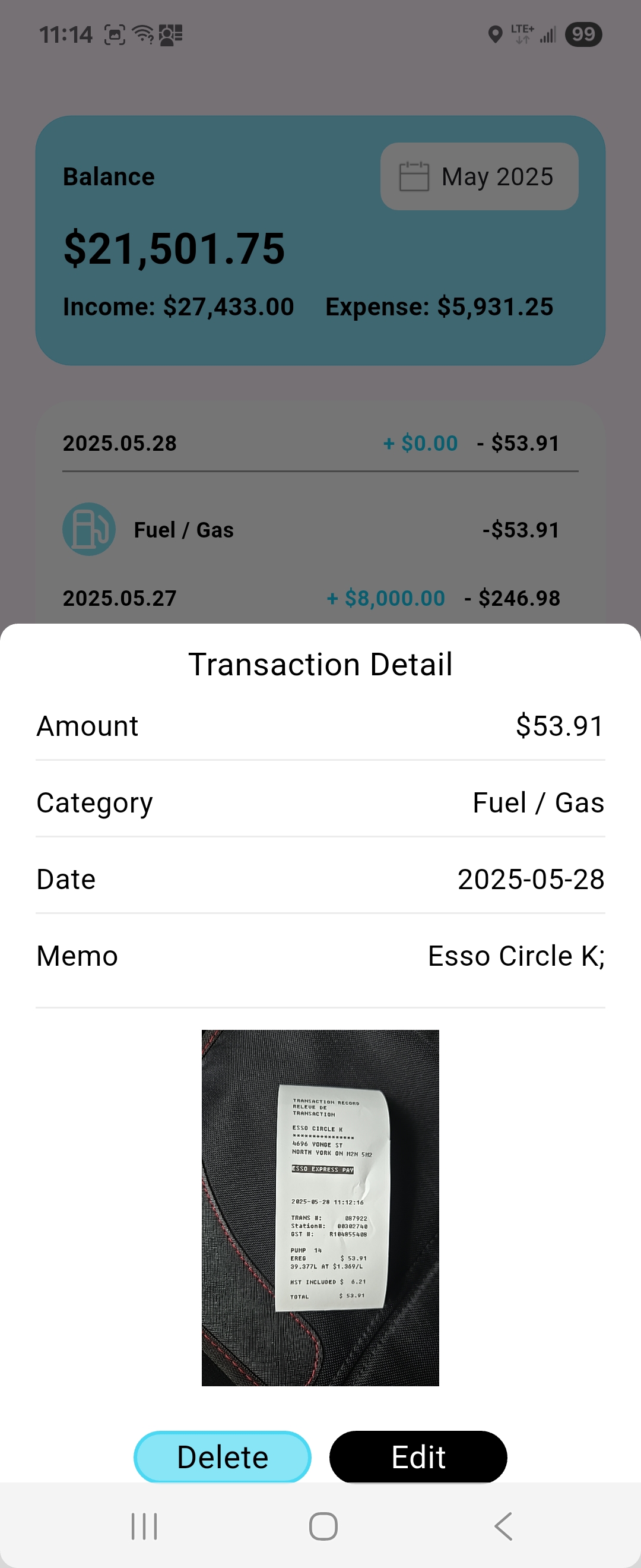

Edit or Delete Transactions

Click on any transaction in your list to view or edit details. Use the delete icon to remove incorrect entries.

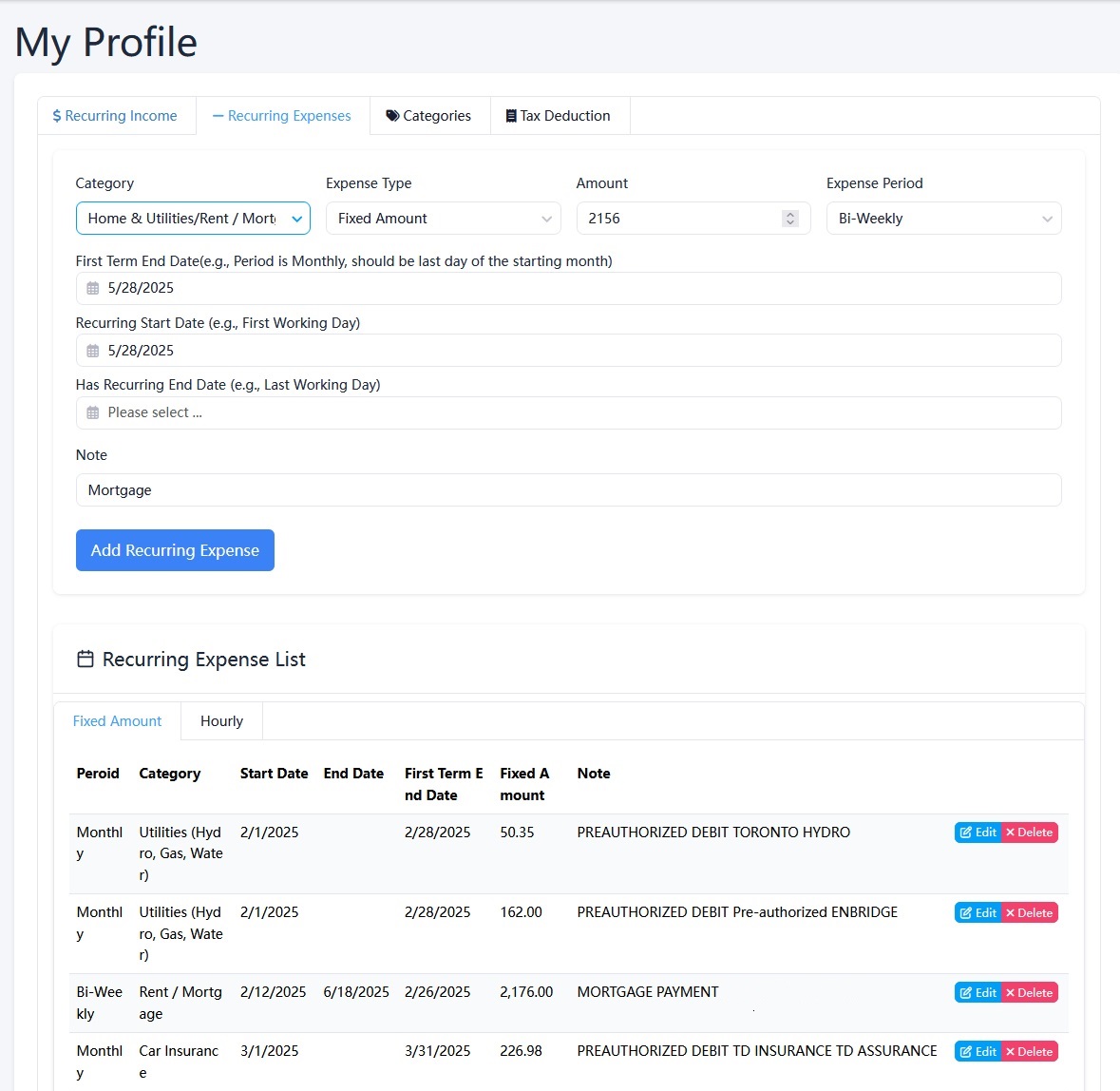

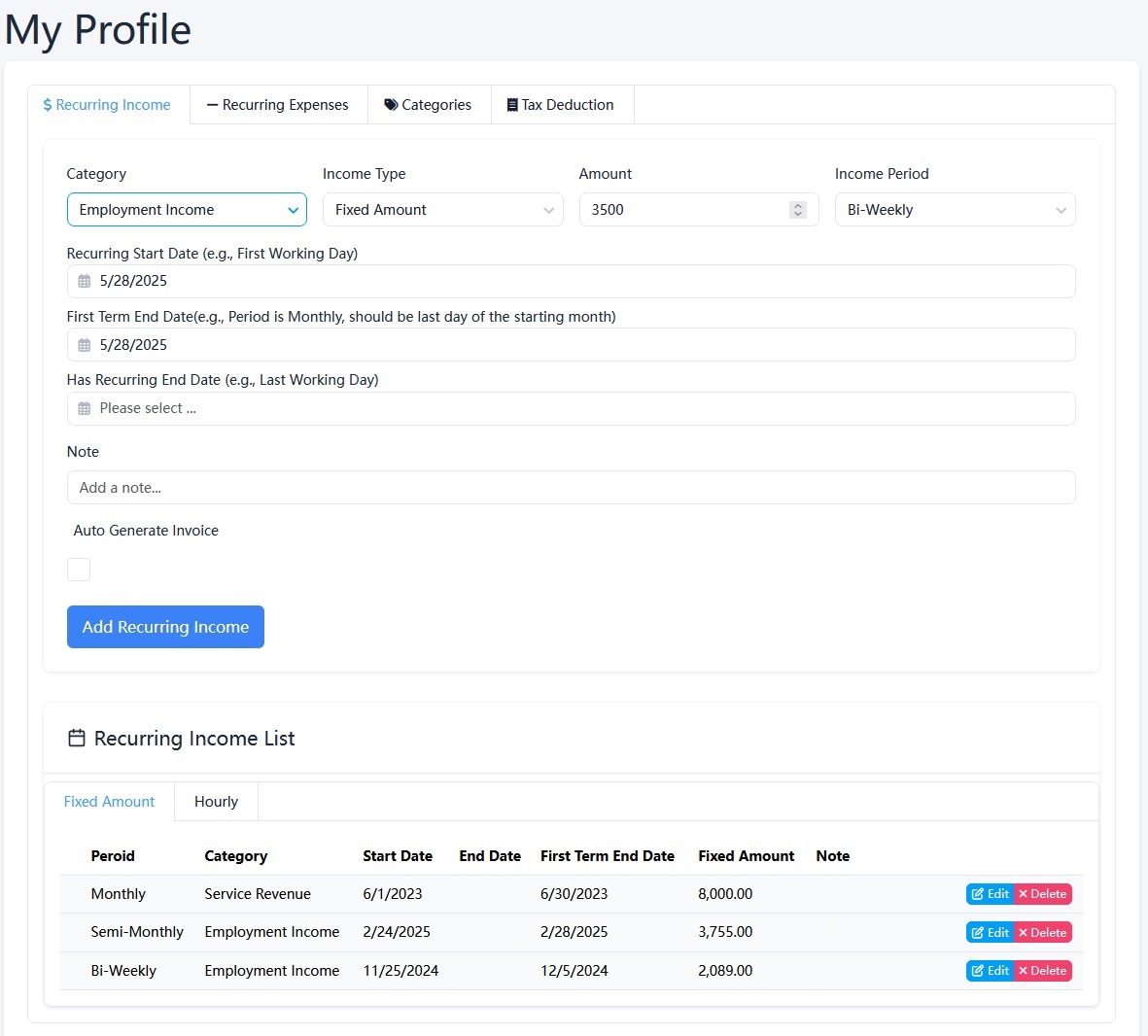

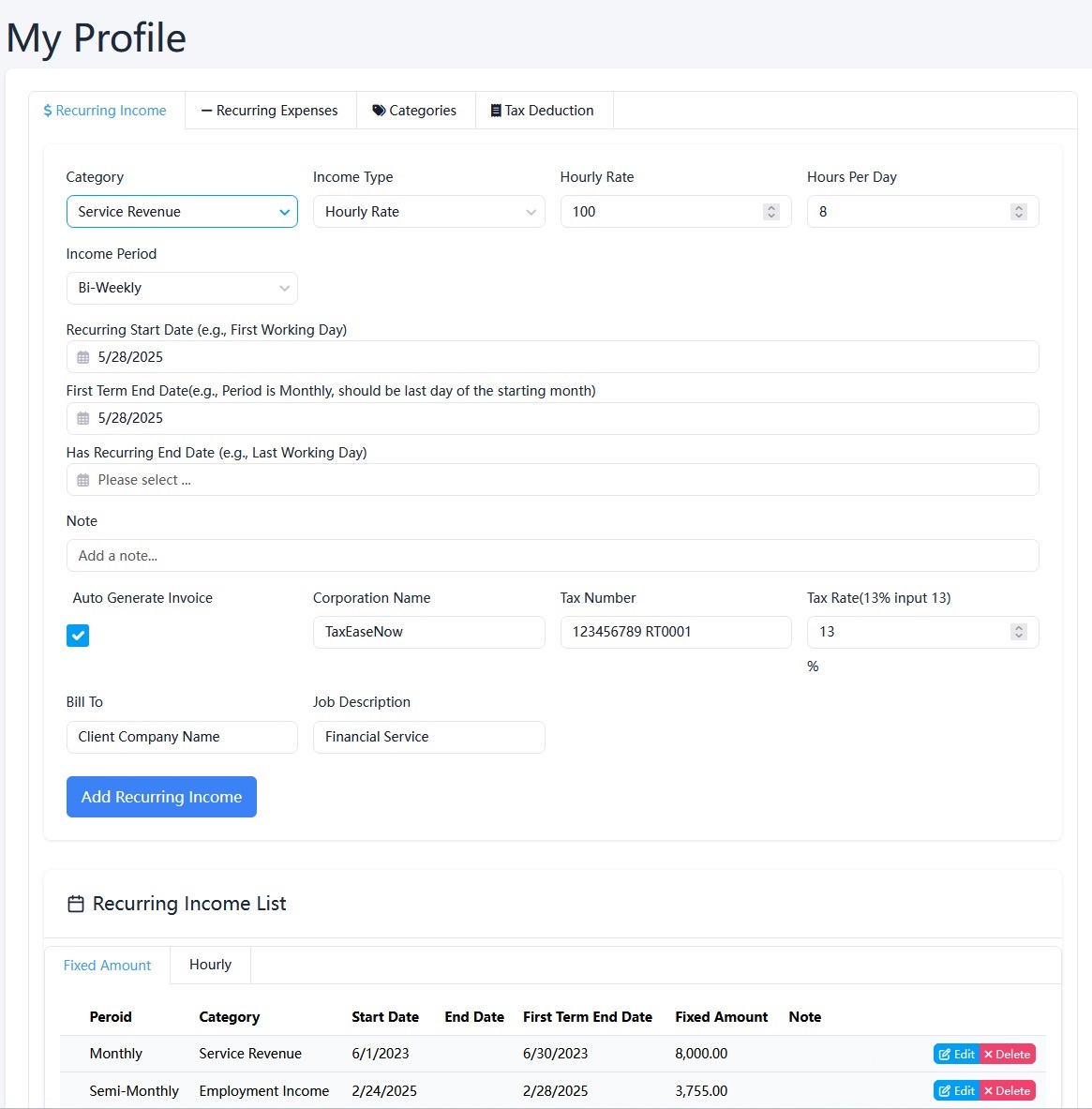

Set Recurring Transactions

In My Profile under Recurring Income and Recurring Expense, set regular transactions (daily, bi-weekly, semi-monthly, etc.)

- Specify fixed or hourly amounts

- Configure company details for auto-generated invoices

The system will automatically generate these records — no manual input needed!

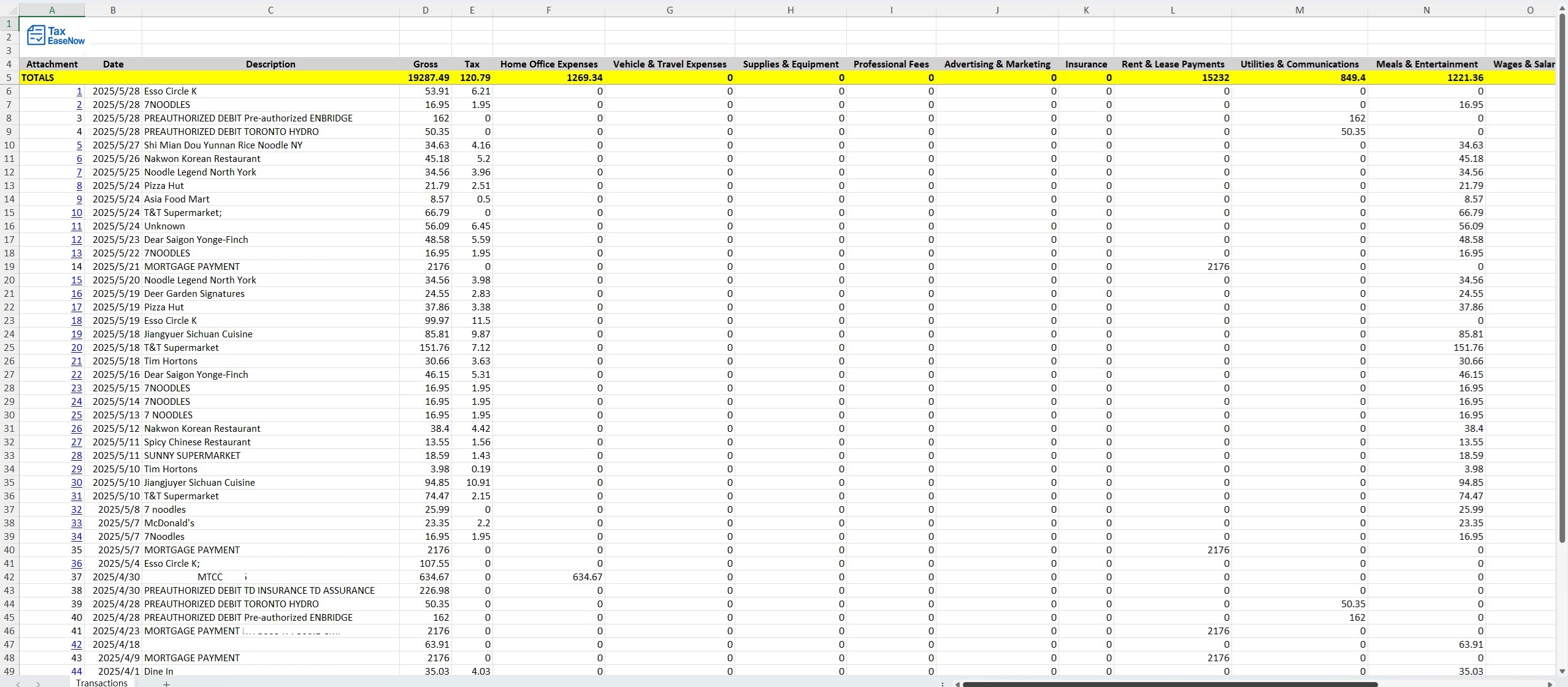

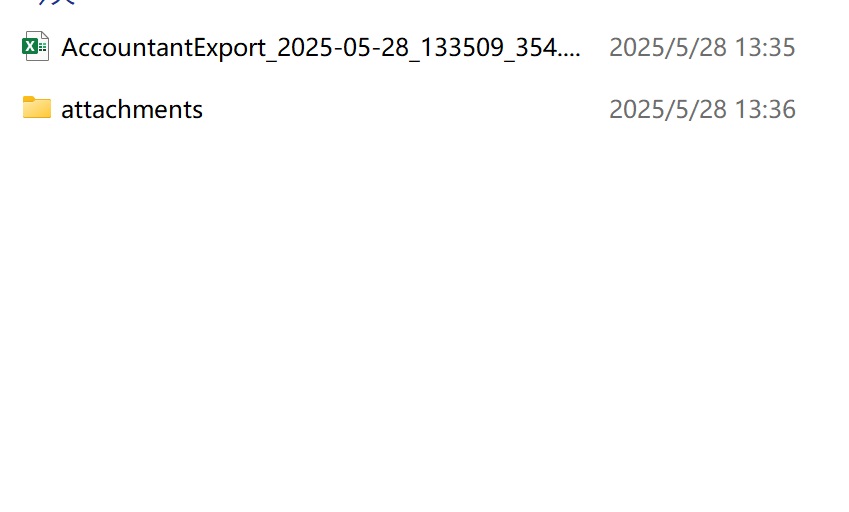

Export Transactions for Tax Filing

On the Dashboard, export all records for a selected time period:

- ZIP file includes an Excel summary and all related receipt images

- Each Excel row links to its corresponding receipt image

Mileage Tracking on Android and iOS

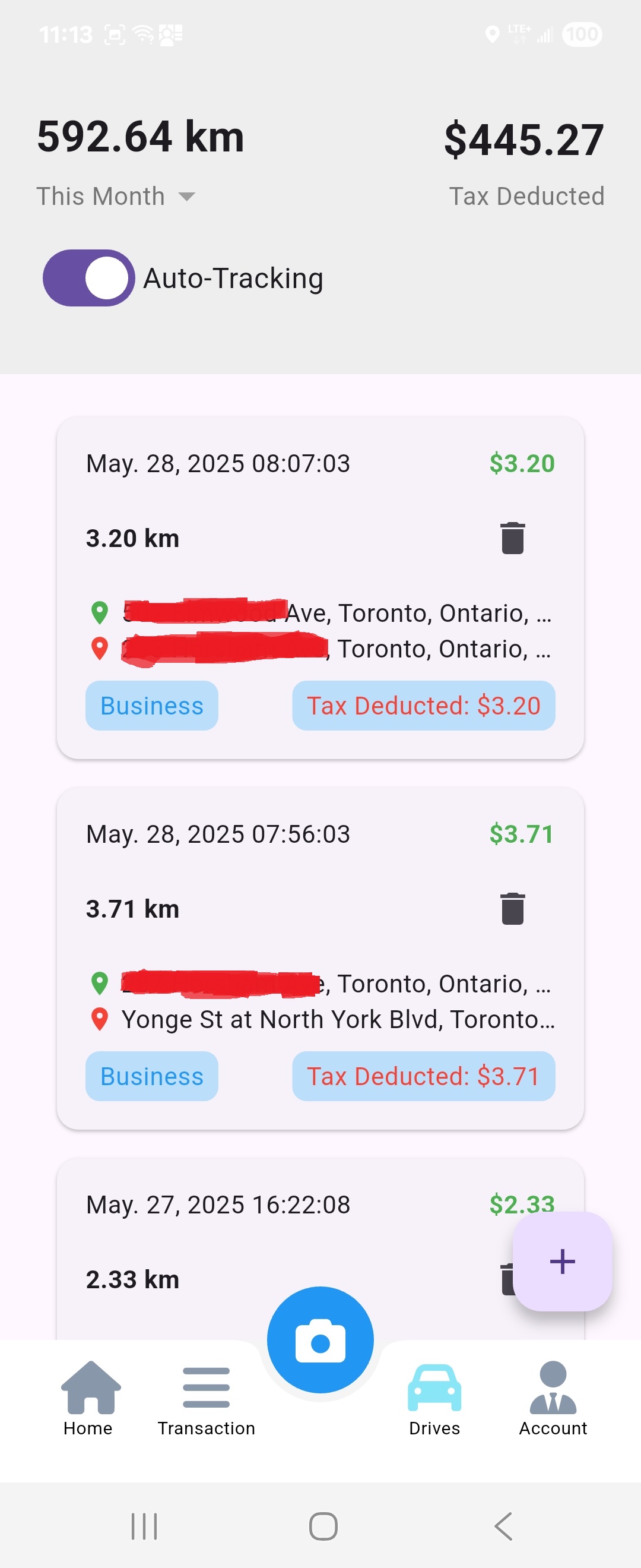

View Drives Overview

Access your mileage tracking dashboard to see all recorded business trips and auto-tracking status.

Toggle Auto-Tracking

Enable or disable automatic trip detection:

- Find the "Auto-Tracking" toggle switch

- Switch on for automatic trip detection using your phone's GPS

- Switch off to manually record trips only

Note: Auto-tracking requires location permissions on your device

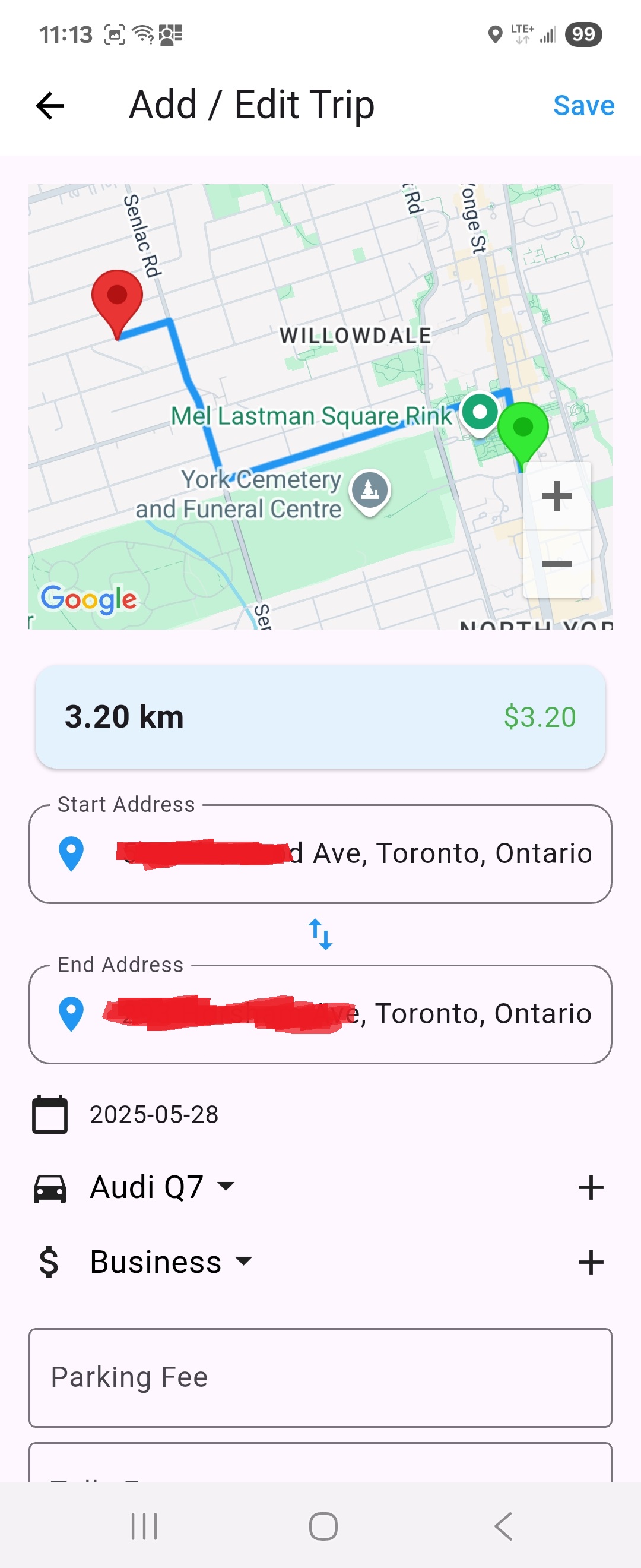

Add a New Trip

To manually record a business trip:

- Click "Add New Trip" from the Drives Overview

- Enter starting point, destination, date, and vehicle used

- Select the business purpose from the dropdown

- Click "Save Trip"

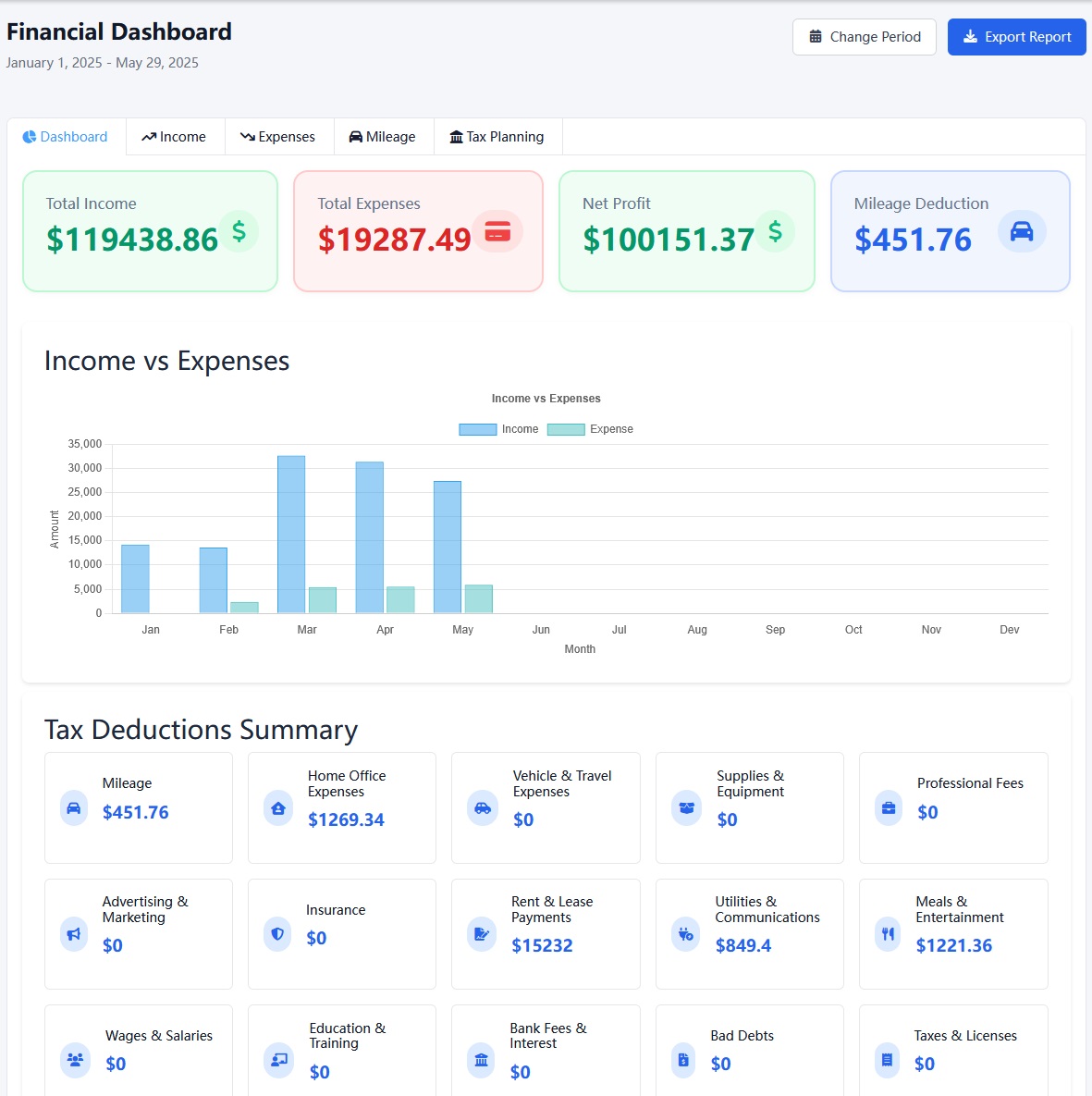

View Tax Deduction Summary

Generate tax-related mileage reports:

- Click "Show Monthly/Yearly Summary"

- Select the time period you want to view

- See your total deductible miles and estimated tax deduction

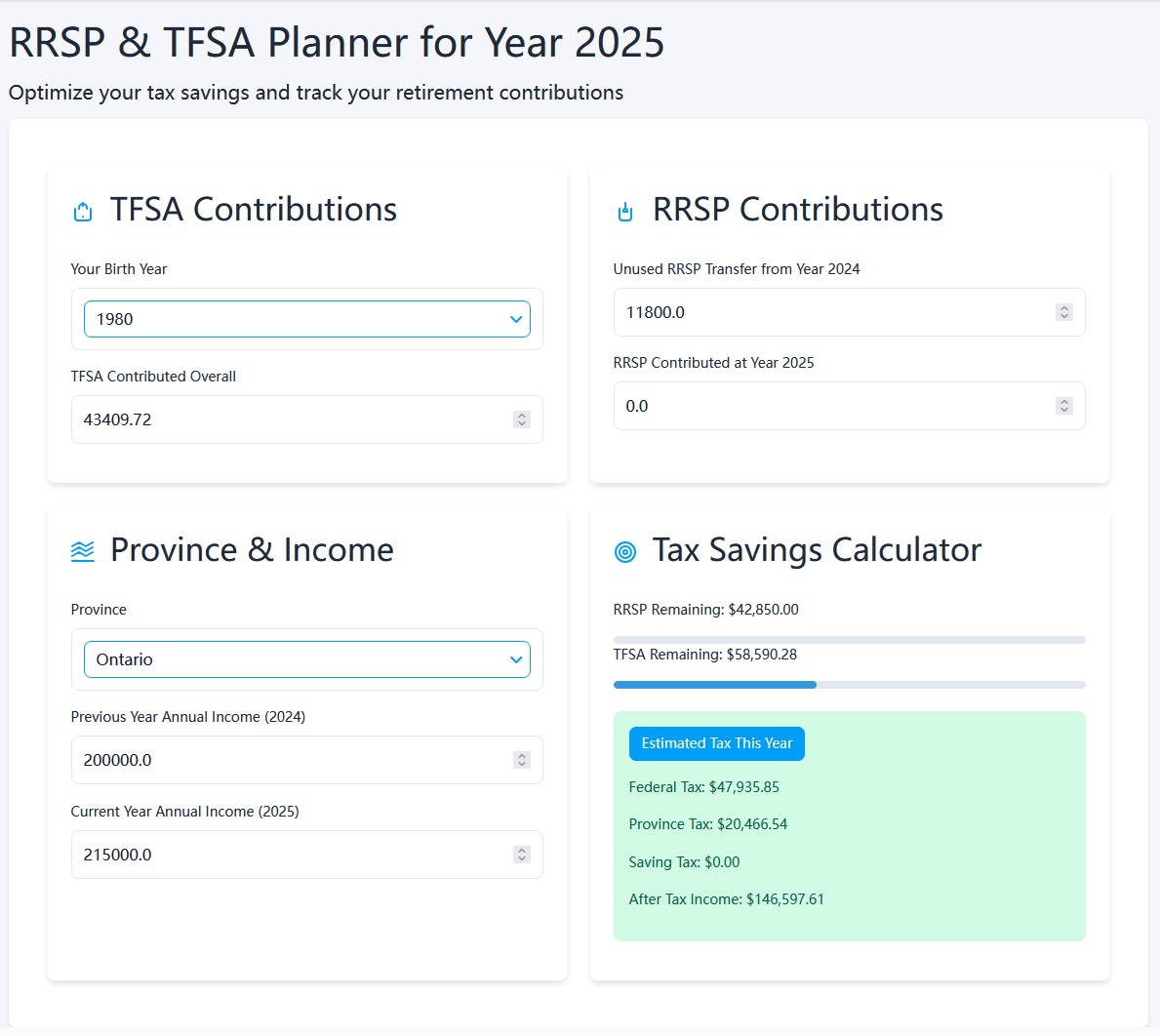

RRSP & TFSA Planner

Access the Planner

Navigate to the RRSP & TFSA Planner from your dashboard to start optimizing your retirement savings.

Enter Your Information

Provide the necessary details:

- Birth year (to calculate contribution limits)

- Province of residence (for tax calculations)

- Previous year income

- Current year income estimate

- Unused RRSP contribution room from previous years

- Planned RRSP contribution amount

View Tax Savings Analysis

After entering your information, you'll see:

- Calculated tax savings from your RRSP contribution

- Estimated taxes before and after contribution

- Projected after-tax income

- Recommendations for optimal contribution amounts

Adjust Your Contributions

Try different contribution amounts to see how they affect your tax situation and find the optimal balance for your financial goals.